2021 proved to be another strong year for the US Capital Markets. The final quarter was no exception to that and also brought a rotation back to large cap stocks and growth stocks. The S&P 500 returned 11% in the fourth quarter and 28.4% for the year. The Russell 2000 (Small Cap Index) returned 2.14% for the quarter 14.82% for the year. Stocks performed well across the board in 2021.

With so much happening in the first quarter of 2022 it’s challenging to remember back to the 4th quarter of 2021. The fourth quarter was dominated by headlines of the Omicron variant of Covid 19 sweeping across the globe and the continued acceleration of inflation in the U.S. economy. Despite all the potential for the market to take a pause and pull back, corporate earnings continued to be the driving force behind the markets strong performance in 2021. However inflation, Covid and host of other events have not just gone away and will likely impact 2022.

You have probably heard us say over the years “the biggest thing the market hates is uncertainty.” This could prove to be true in a number of ways in 2022. Inflation, mid-term elections, Covid, a Russian/Ukrainian conflict, all of which have unknown outcomes and could impact the market in significant ways. Let’s address each one.

Inflation:

The high inflation numbers have stalled the movement of future proposed government spending programs and forced the Federal Reserve to accelerate the tapering of liquidity. In addition, interest rates hikes are now a virtual certainty, the only question remaining is how far and fast the rate hikes will be. The key 10-year treasury bond rate has risen substantially causing growth stocks to retreat in the early weeks of 2022. As the U.S. economy continues to reopen post pandemic, GDP growth remains strong and importantly, S&P 500 earnings remain strong. Supply chain issues and lack of available labor have caused disruptions in most businesses, but most company’s ability to raise prices has more than made up cost overruns. This is one reason our inflation numbers have been high.

Election:

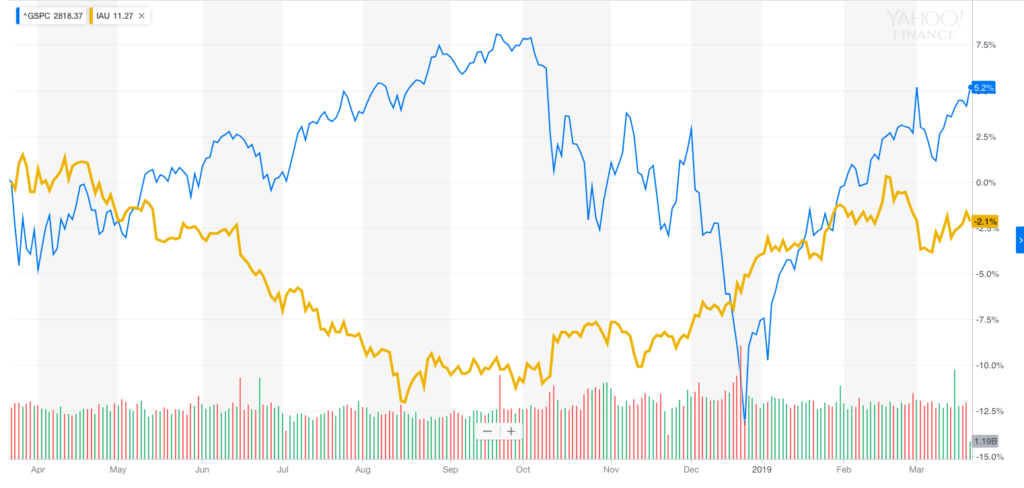

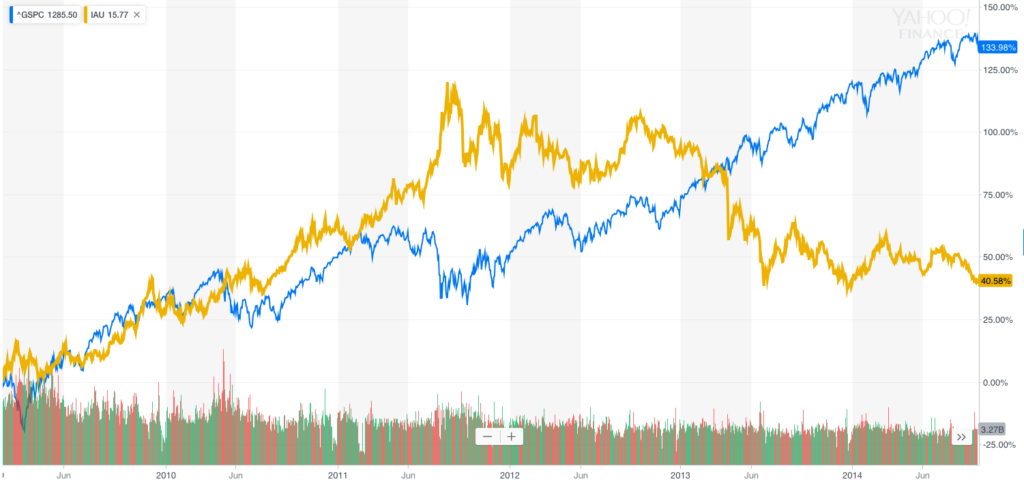

It’s hard not to look back to 2019 and see a similar situation to where we find ourselves today. Without making political statements, it would appear that the mid-term election outcomes look fairly certain, but this appeared to be the case in early 2020 as well, but then Covid 19 arrived in March and everything changed. We may see an outcome shifting event this year, we may not. Again, this is just another point of uncertainty that will effect the markets in the short term.

Covid:

While there are still daily cases of Covid across the globe and US, Covid in large part seems to be moving to the rear view mirror and something we will have to work around and with versus dominating headlines and our daily lives. Covid restrictions across the country are largely ending or have already ended and should allow the US to return to closer to pre-pandemic life. This will be good for the economy and the markets. We should see supply chains open back up, factories fully reopen and host of other restrictions lifted that will only be positives for the economy. All of this should be a good for economic growth and Markets in 2022.

Russian/Ukrainian Conflict:

Obviously this has been the major news over the last 7 days. We are very hopeful that this conflict comes a quick and peaceful end and both sides will walk away from this war. The US and Western World has taken a strong stance against Putin and short of engaging in direct fighting with Russian troops, we have used every tool to inflict maximum pain on Putin. Our sanctions will no doubt impact the Russian economy and could have long-term effects in Russia. The largest impact to the US Economy, and the global economy, could come from Russian oil. If Russia decides to stop supplying the west with oil we would see an increase in gas prices which will no doubt have far reaching impacts to the global economy. The second largest impact will be if Russian stops exporting grain/wheat. This would also have a large impact on the global economy as we would see the price of wheat increase overnight. Again, we are hopeful that this conflict comes to a quick and peaceful resolution with minimal long-term impacts.

With all this uncertainty, so far in 2022 markets have been extremely volatile and predominantly negative. This year will have some major changes in some long-term trends that have fueled the markets higher. First, as mentioned above, interest rates have been trending down for decades and 2022 will undoubtedly see rising interest rates for the entire year and rates hikes will likely continue into 2023 and 2024. Second, the avalanche of liquidity provided by the Federal Reserve and the U.S. government will slow dramatically. Third and most important, corporate earnings will likely remain strong in 2022, but after the economy is fully reopen, the rate of growth will likely return to a long-term trend of 2%-ish. Even though earnings will still be rising, the market doesn’t particularly care for decelerating growth and will add to volatility.

2022 will most likely be headlined by national and global events leading to increased volatility. But, we feel in spite of this the markets should have positive returns this year. Fundamentally the market should reflect earnings and the broader economy. With unemployment at almost pre-pandemic levels, GDP growth between 3-5% and corporate earnings still positive we see the market responding positively to these as the year progresses.

As always if you have any questions please don’t hesitate to reach out to us.

All the Best,

Bryan, Gary, Thane and the Cascade Team